Project Background

Project Background

AutoPay is a marketplace that offers a variety of automotive finance, refinance, and protection options to consumers. At the moment, AutoPay obtained leads for potential customers seeking auto refinance or other related products through third-party companies such as NerdWallet and CreditKarma. These companies have access to customers' financial profiles and use this information to suggest alternative financial products based on their credit profile.

In 2022, the leadership team at AutoPay made the decision to develop a new product that would allow them to handle the entire end-to-end experience in-house, rather than relying on third-party services. This led to the creation of Atla.

San Jose, CA, US

Digital Product Designer

AutoPay / Atla

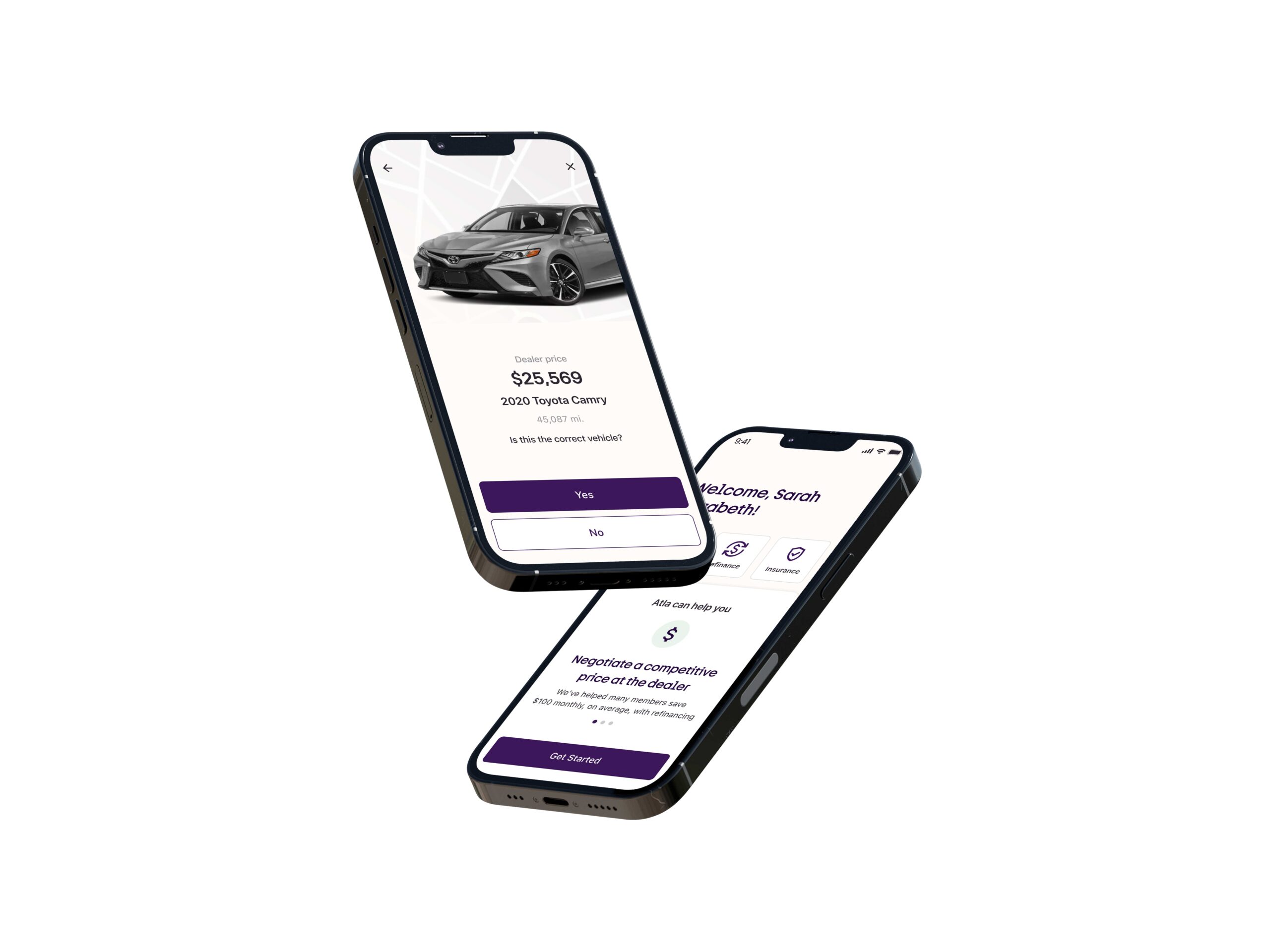

Atla's mission

Atla's mission

The mission of Atla is to provide drivers with the tools and guidance they need to make informed, confident decisions about car ownership and navigate the financial complexities of car ownership. On average, Atla's customers save up to $100 per month.

Design Process

Design Process

The design process we followed involved multiple meetings between a technical product manager, a member of leadership, the head of engineering, and a product designer (myself) to establish requirements. During this process, I worked closely with the product manager to ensure that all necessary information was captured and considered in the design. However, due to time constraints and Atla's status as a startup within a larger company, we were unable to fully implement a user-centered design process and conduct user research to validate our design decisions for the MVP.

My role

Design Process

As a Lead Product Designer, I joined the team and took the initiative to collaborate closely with other UI designers to establish a design system and ensure that the overall look and feel of the app aligns with our branding guidelines. I regularly interacted with developers to ensure that they had the necessary resources for upcoming sprints. In addition, I worked closely with the product team, including leadership, product managers, and an engineering lead, to assist them with requirements and MVP roadmap items. I also collaborated with the Product Manager and Content Designer at various stages of the design process to create user flows.

I began by creating user flows and high-level blueprints for the main flows, based on the established requirements. Then moved on to creating low-fidelity wireframes. For stakeholder presentations, I was required to create high-fidelity mockups, even though it goes against best practices to present unapproved concepts in such detail. However, this was a specific requirement for this project.

Research

Research

A research agency was hired to conduct more than 25 user interviews to gather insights about customers financial products, the frequency of significant financial decisions they make such as purchasing a vehicle, and users' attitudes towards financial digital products like mobile apps. The research was used to inform the development of Atla.

The preliminary user interviews revealed the following insights:

- Users often turn to friends and family members who have recently financed a vehicle and will consider the financial institutions or dealerships used by their trusted contacts.

- Users tend to stick with financial institutions with which they already have relationships.

- Many users do not trust dealership salespeople and prefer to bring a friend or family member with them when visiting a dealership.

- Most users are unaware that they can apply for a refinance to obtain a better rate almost immediately after purchasing a car.

- Most people find the car purchase experience to be stressful and overwhelming, rather than enjoyable

Our research identified two main outcomes that influenced the design of our MVP to some extent. First, we found that building trust with users is important for them to proceed with their purchase. Second, we discovered educating users through out their journey is crucial as most users may need assistance in understanding the loan calculations, as they can be overwhelming.

Purchase

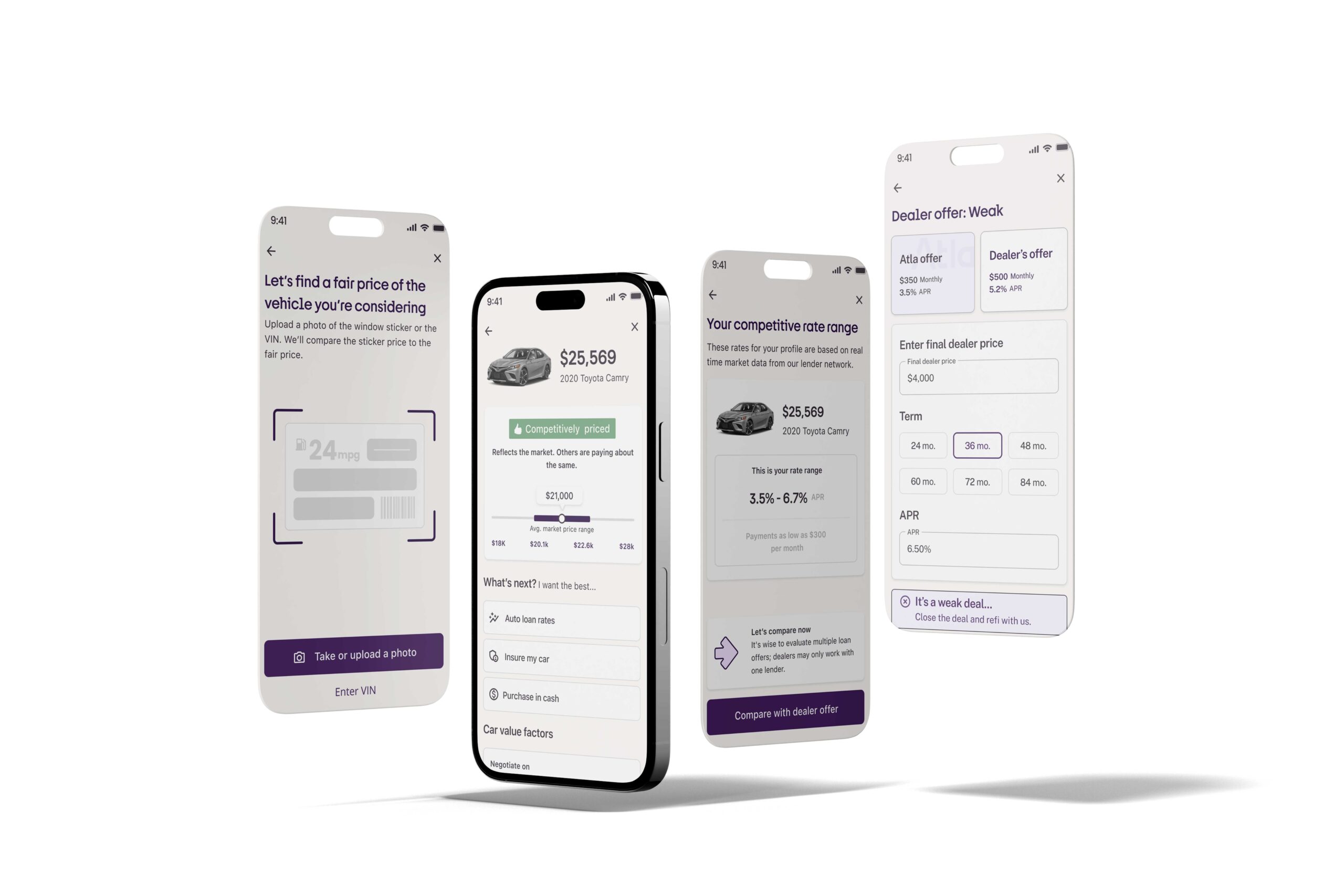

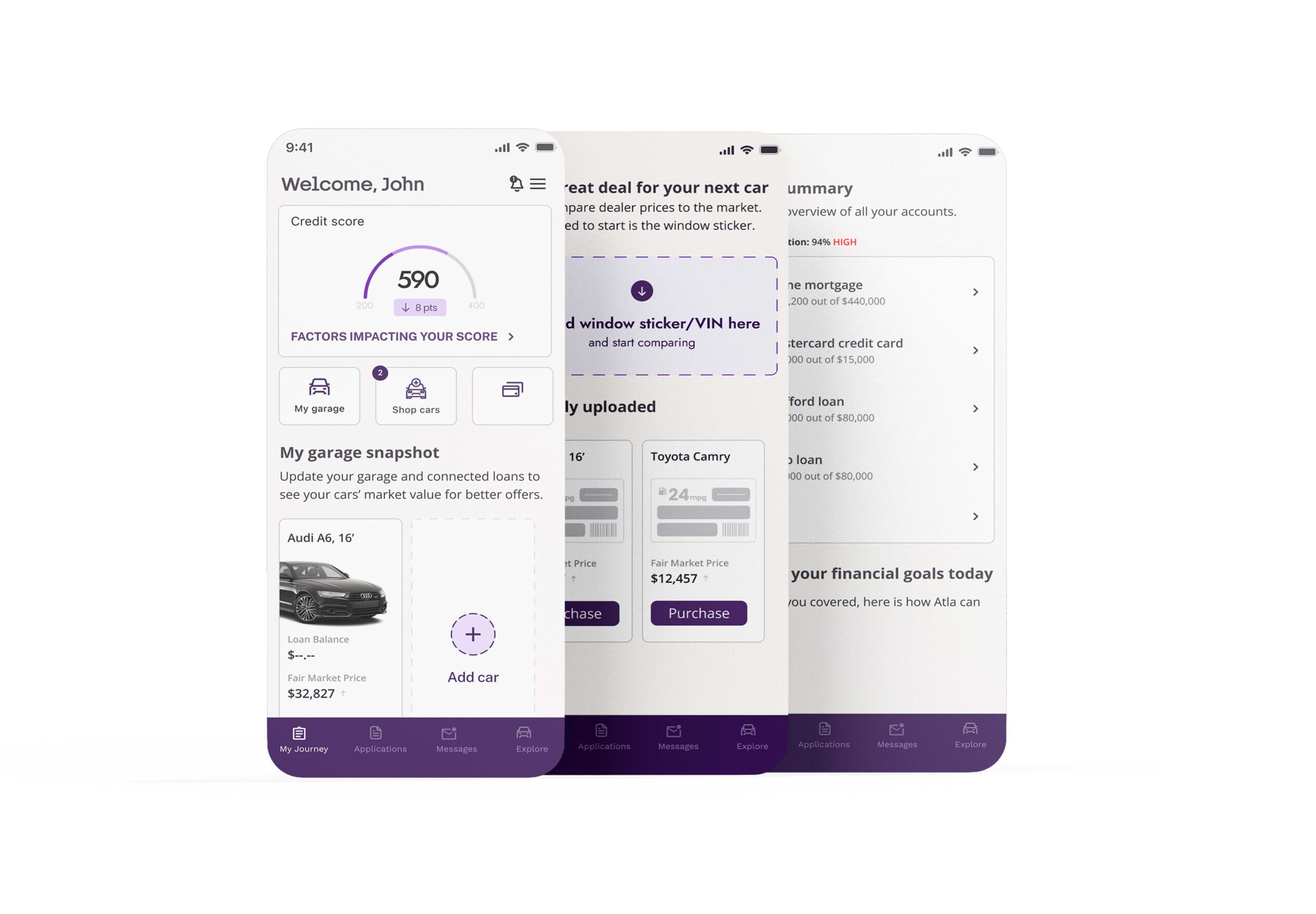

Atla arm users with powerful market intelligence about vehicles they're considering, as easily as snapping a photo.

Bring Atla to the dealership

Create an Atla account, either online or through the mobile app, to access powerful tools to help guide your vehicle purchase and save money.

Snap the window sticker

You found a car you like. But is the price right? Upload a photo of the window sticker using the Atla app.

Get instant price insights

Using industry data sources, we build an analysis telling you what’s a fair price for the car.

Negotiate with knowledge

Next, you get to flex your negotiating skills armed with facts and figures that put you in control.

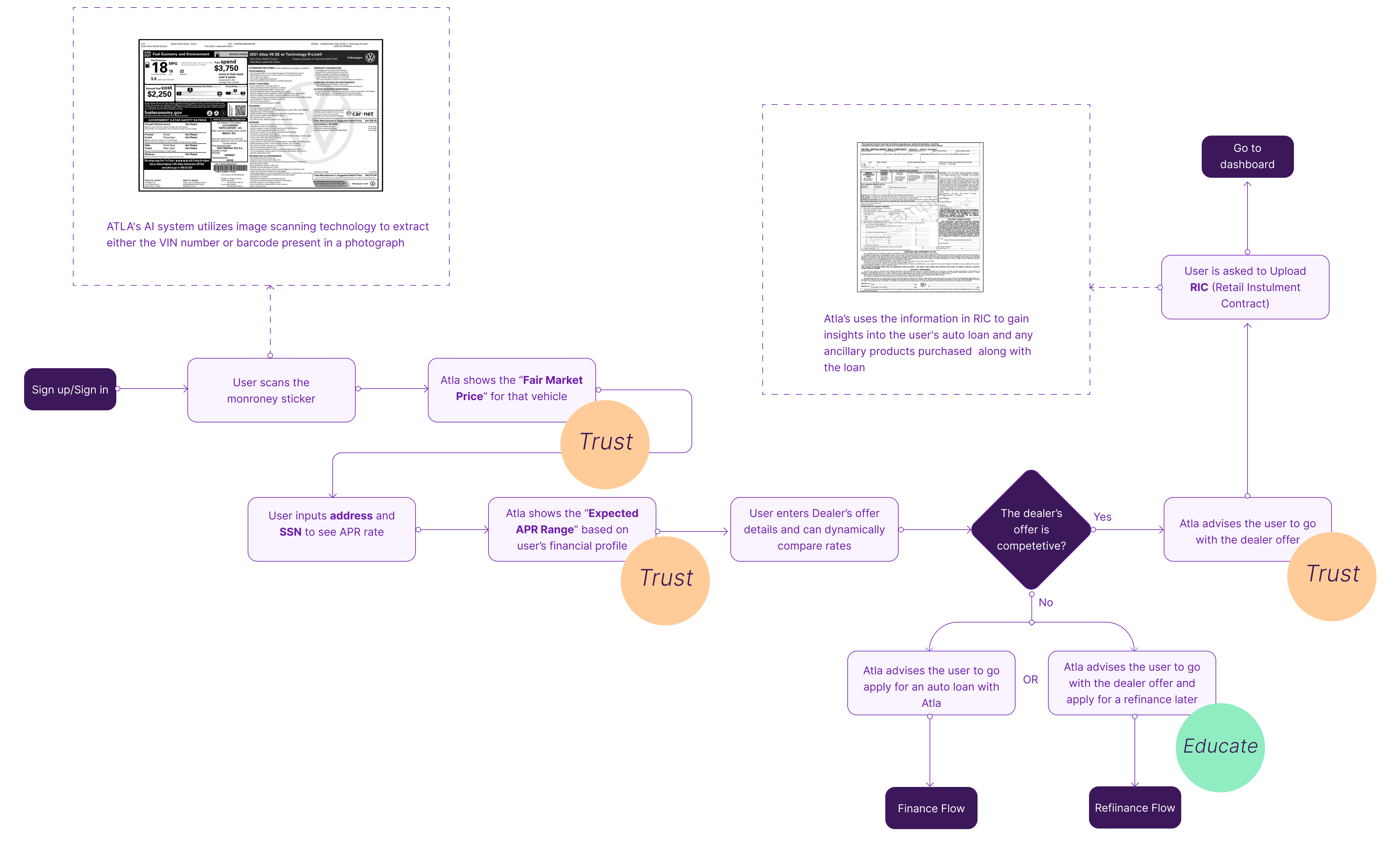

Purchase user flow

Purchase user flow

Once the user is ready to buy their next car, Atla helps them put the dealer’s financing offer in context with a powerful loan comparison calculator. It’s a three step process:

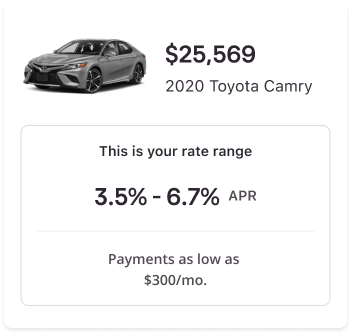

Check for competitive rates

First, you provide just a few pieces of information. We generate a range of eligible car loan rates by consulting Atla’s nationwide marketplace of lender partners.

Enter dealer financing offer

Next, plug in figures from the dealer’s loan offer. Dealers often work with just one lender to provide financing. It’s wise to know what else is out there.

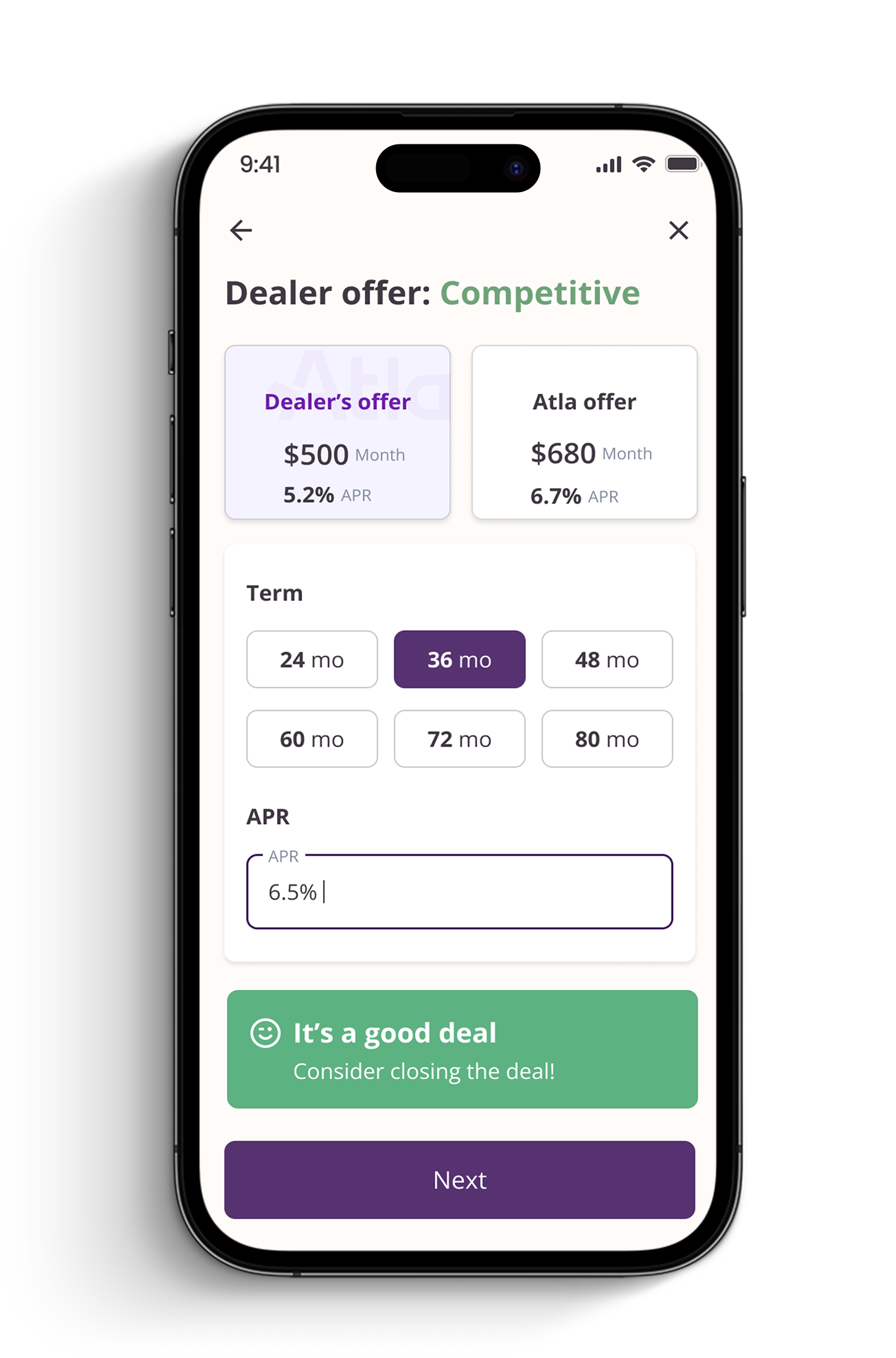

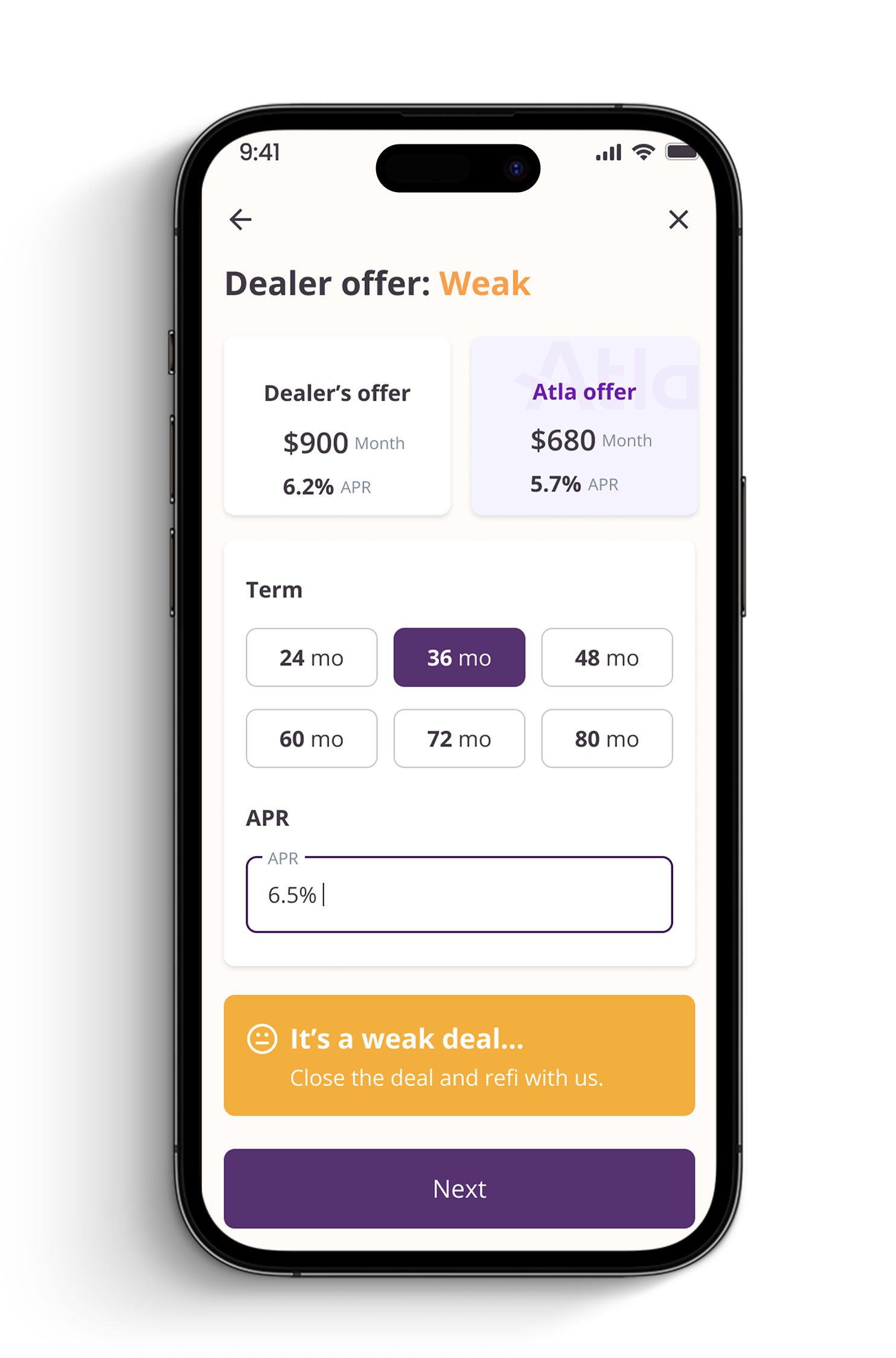

Dynamically compare rates

Our side-by-side loan calculator shows how the dealer offer compares to the market. You can even adjust factors like down payment to instantly see their impact on loan pricing.

How did we apply Trust and Education?

Purchase user flow

We aimed to earn customers' trust by providing them with the necessary information to negotiate with dealers, including the average market APR range they should expect. Additionally, we educated them with a manageable amount of information presented contextually throughout their journey. For example, we informed them that they can apply for refinancing immediately after purchase without affecting their credit score and what additional products they may need to purchase.

Dashboard

Dashboard

Atla looks for better-fitting loans so cusromers don't have to.With a marketplace of over 250 lenders at our disposal, Atla can alert users to competitive loan opportunities that outperform your existing auto financing. As factors like customer's credit score and the interest rate environment fluctuate, Atla sends you any new competitive loan opportunities in real time.

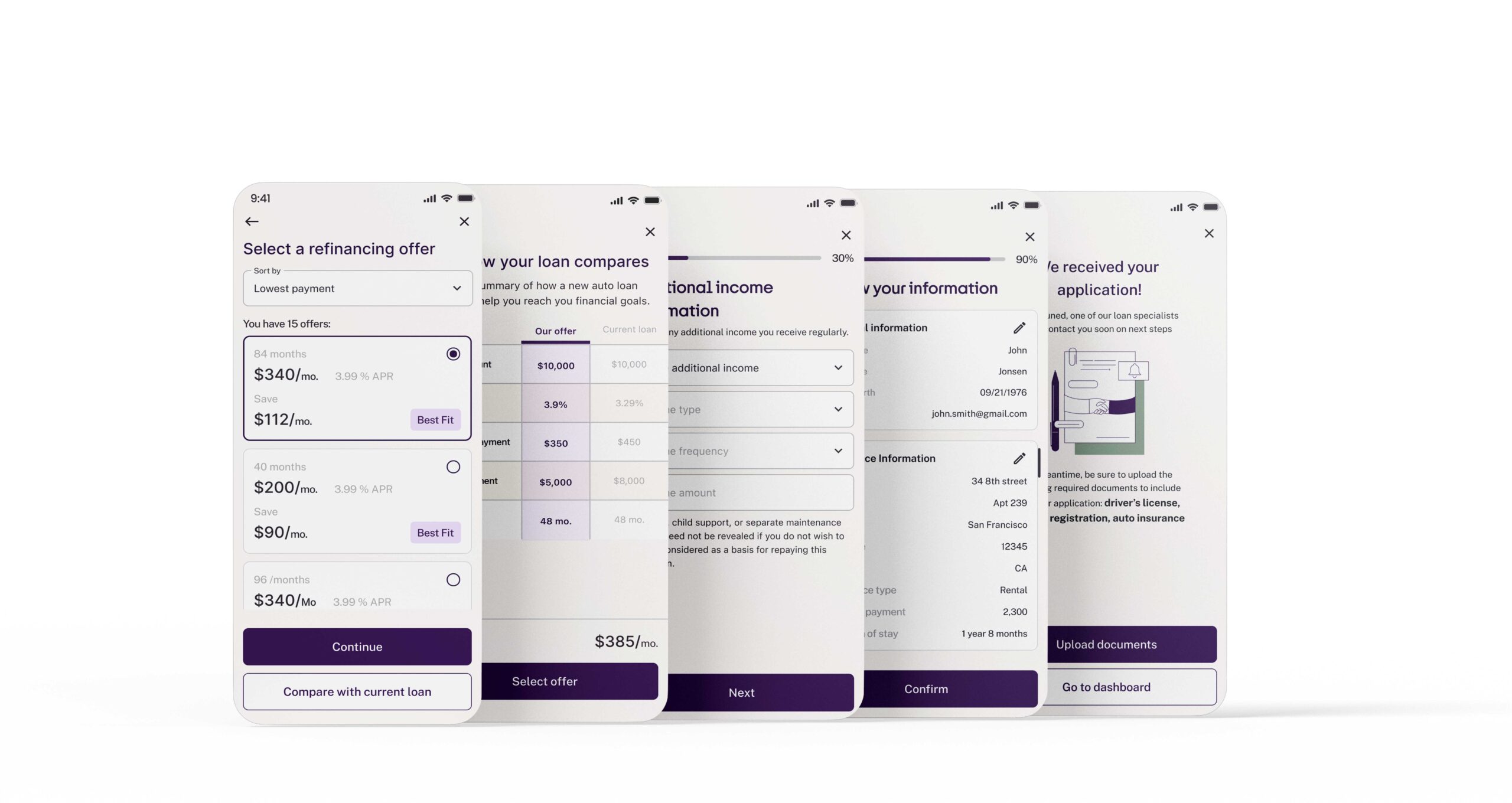

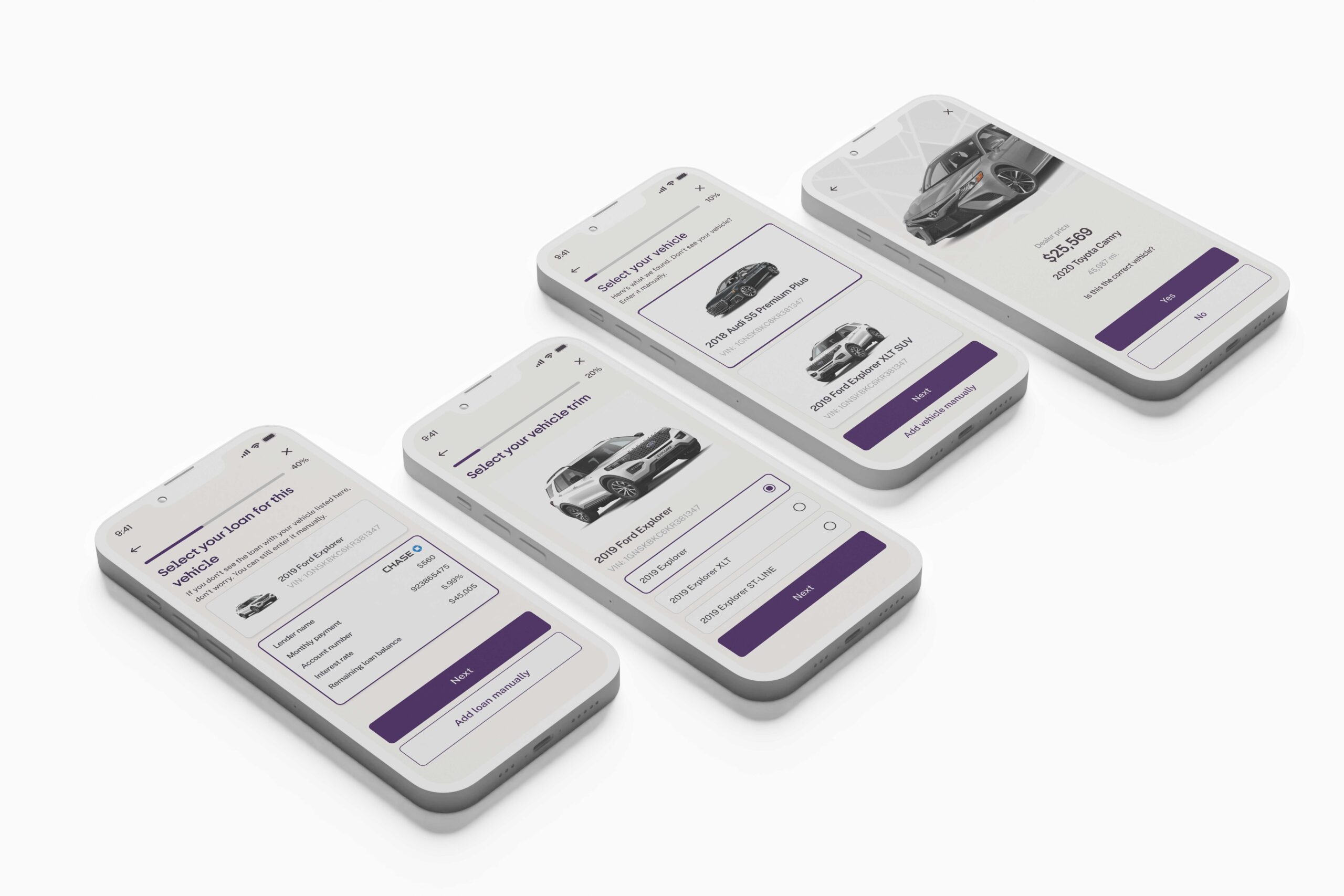

Refinance

Refinance

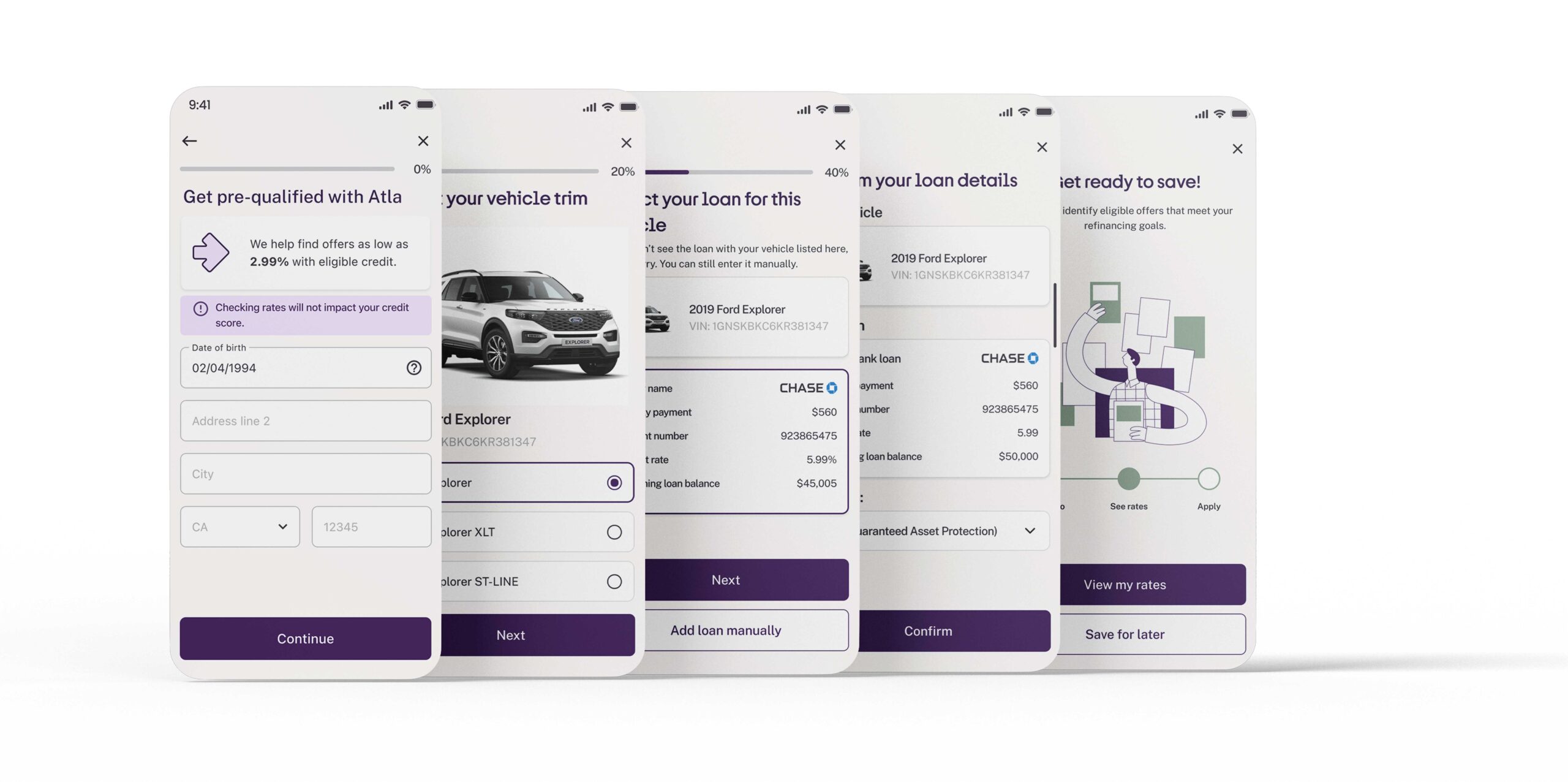

Customers who are ready to refinance their auto loan can easily create an account with Atla's digital tools. In just minutes, these tools can identify the user's vehicle and current loan.

Atla then helps users get instantly pre-qualified for refinancing by presenting loan opportunities from a database of over 250 lending institutions. These options often have lower interest rates compared to the user's current loan.

To finalize their application, users simply need to provide a few more details and click "submit."

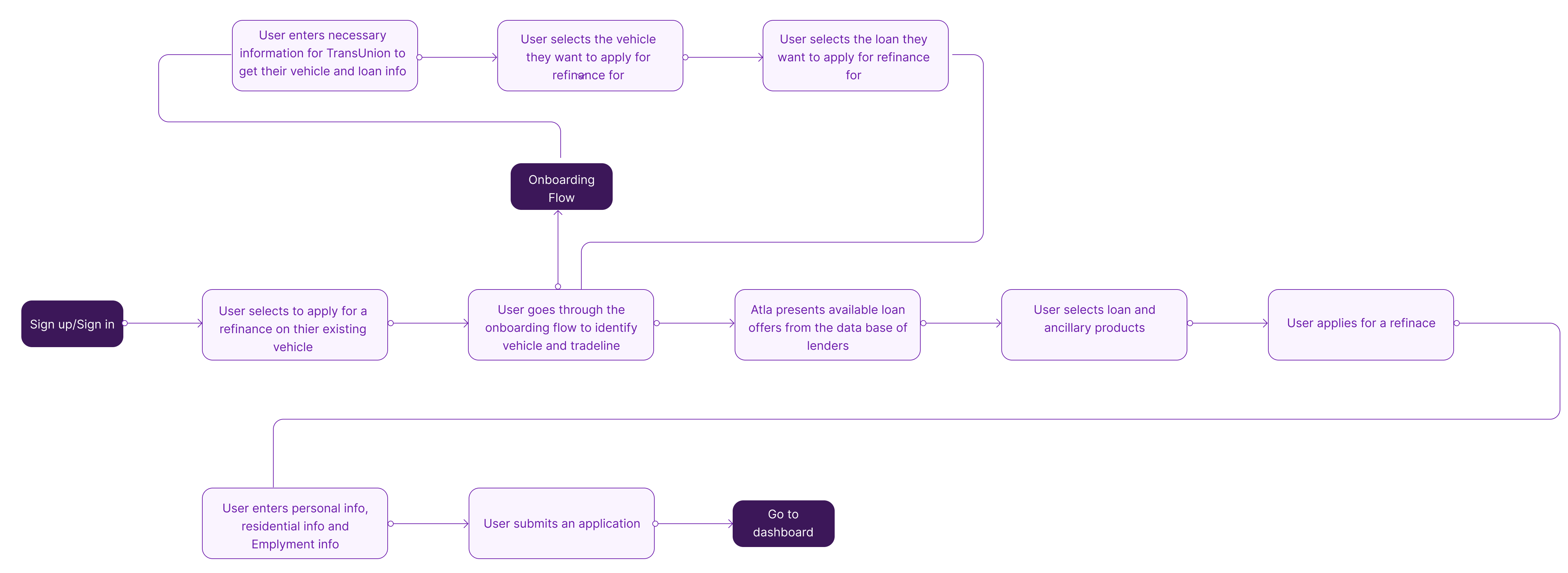

Refinance user flow

Refinance user flow

Refinance Onboarding

Refinance Onboarding

Refinance Application

Refinance Application